- 分析

- 技术分析

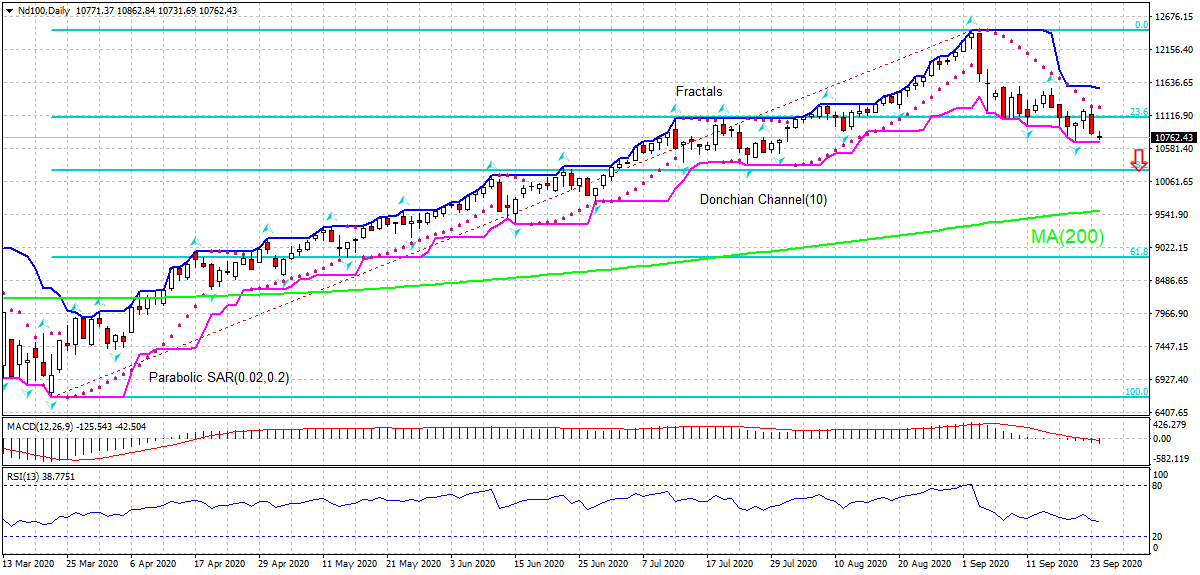

纳斯达克指数 - NDX100 技术分析 - 纳斯达克指数 - NDX100 交易: 2020-09-24

Nasdaq (100), 股票指数 技术分析总结

低于 10675.86

Sell Stop

高于 11547.67

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| MA(200) | 买进 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

Nasdaq (100), 股票指数 图表分析

Nasdaq (100), 股票指数 技术分析

On the daily timeframe the Nd100: Daily is retreating toward the 200-day moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 10675.86. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 11547.67. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (11547.67) without reaching the order (10675.86), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

指数 基本面分析 - Nasdaq (100), 股票指数

Markit’s composite purchasing managers index for September declined in US. Will the Nd100 retreat continue?

Bears have gained the upper hand in US stock market as weak economic data point to slowing growth of US economy. Markit reports yesterday signaled a slower pace of growth in September. The flash reading for composite purchasing managers index from IHS slipped to 54.4 in September from 54.6 in the prior month. It was due to slowing expansion in services sector as flash services purchasing managers index inched down to 54.6 from 55 in August. However the flash manufacturing index rose to 53.5 in September from 53.1 in the prior month. And Randal Quarles, the Fed’s vice chairman, said that continued support of Congress and monetary authorities will be required to sustain a robust recovery. However lawmakers cannot agree on additional stimulus measures and investors see dwindling likelihood of another aid package before presidential election. Weak economic data are bearish for Nd100.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.