- 分析

- 技术分析

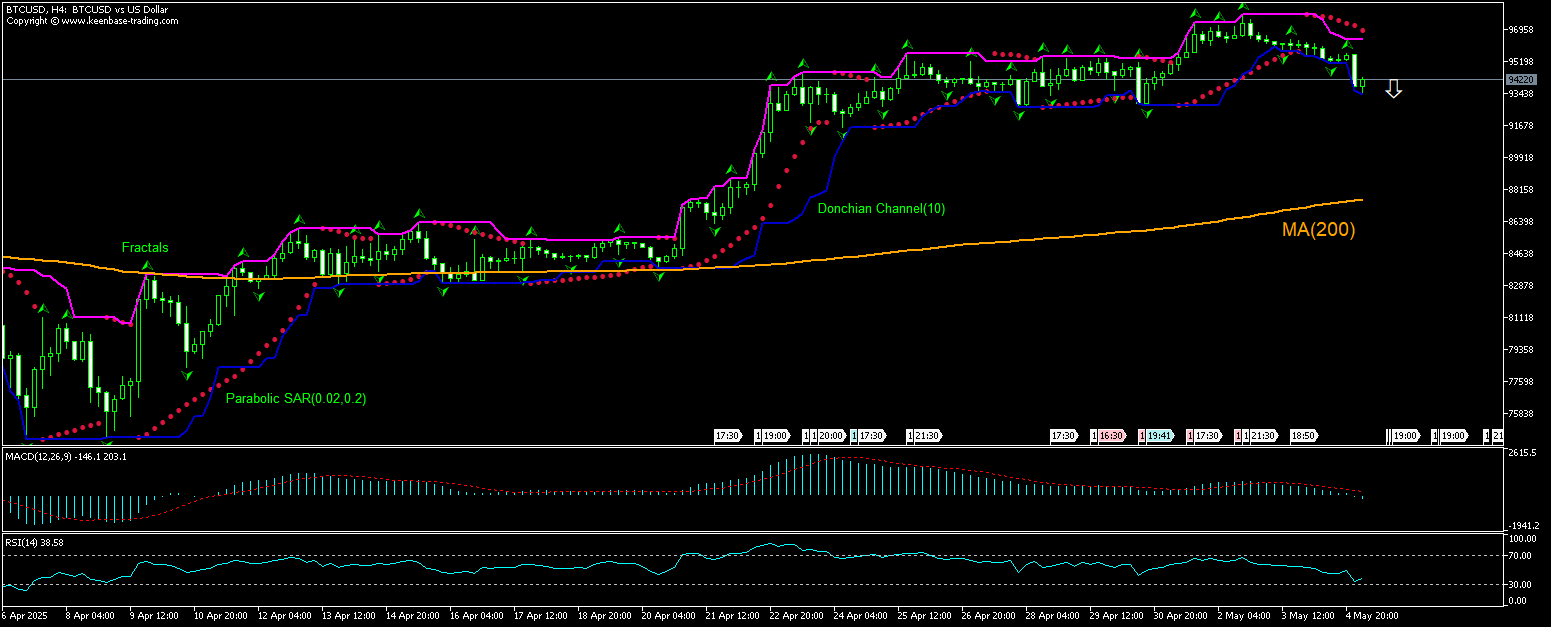

比特币/美元 技术分析 - 比特币/美元 交易: 2025-05-05

比特币/美元 技术分析总结

低于 93386

Sell Stop

高于 96396

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| Donchian Channel | 卖出 |

| MA(200) | 买进 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

比特币/美元 图表分析

比特币/美元 技术分析

The BTCUSD technical analysis of the price chart on 4-hour timeframe shows BTCUSD, H4 is retracing down toward the 200-period moving average MA(200) after hitting all-time high three days ago. We believe the bearish momentum will continue after the price breaches below 93386. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 96396. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

加密貨幣 基本面分析 - 比特币/美元

The Blackrock head of digital assets says Bitcoin “might be risky not to own.” Will the BTCUSD price continue declining?

The Blackrock head of digital assets says institutional investors interest in Bitcoin could rise dramatically if the cryptocurrency proves it can behave independently of risk-on equities and can be used as a hedge asset. If the asset can exhibit lower or even inverse correlation to what he referred to as “left tail” events—severe and rare negative market occurrences—it could gain substantial appeal as a hedging tool. A transition from a speculative bet to a strategic necessity will take place in such case in the eyes of large investors as their views shift from ‘Is this too risky for us?’ to ‘Might it be risky not to own any?’

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.