- 分析

- 技术分析

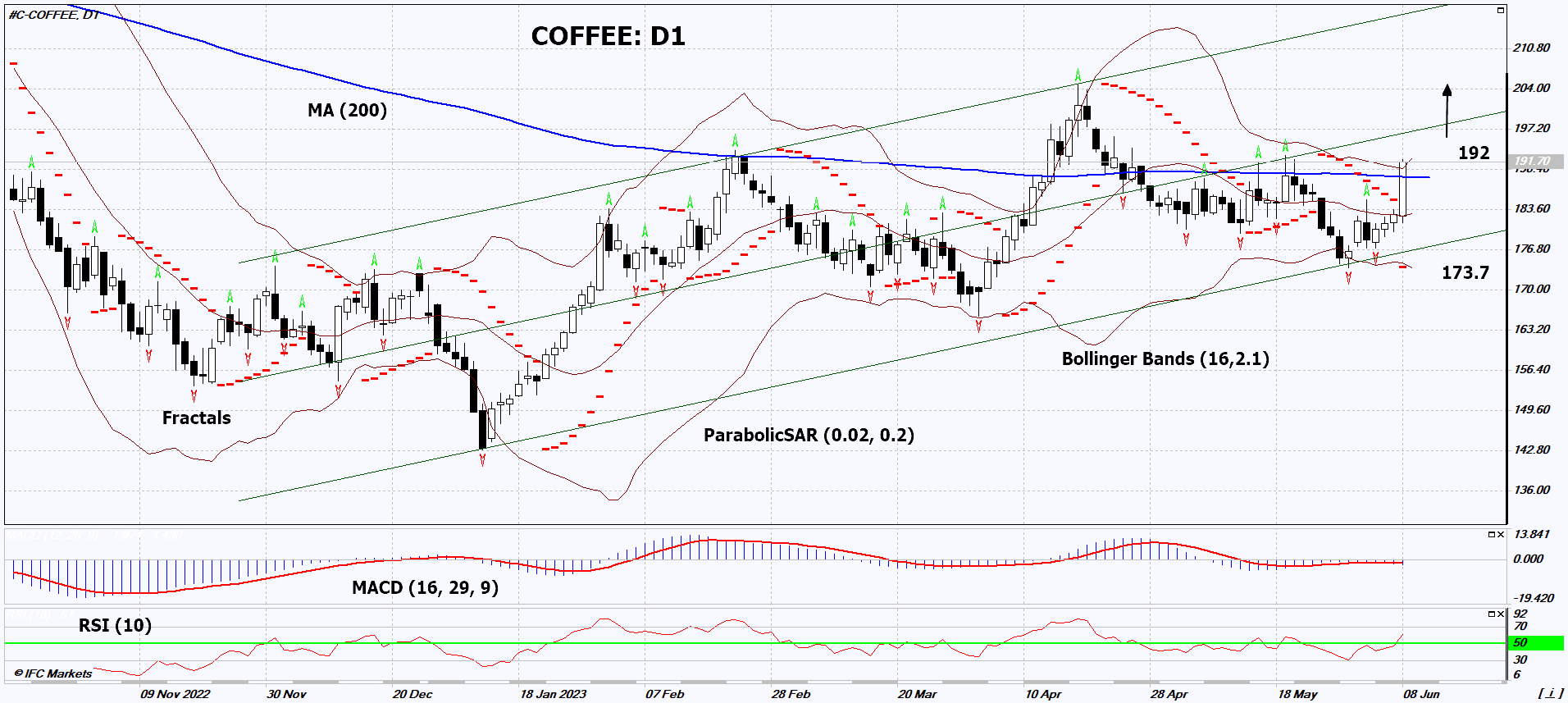

阿拉比卡咖啡 技术分析 - 阿拉比卡咖啡 交易: 2023-06-09

阿拉比卡咖啡 技术分析总结

高于 192

Buy Stop

低于 173,7

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 中和 |

| MA(200) | 买进 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 买进 |

阿拉比卡咖啡 图表分析

阿拉比卡咖啡 技术分析

On the daily timeframe, COFFEE: D1 is moving towards the upper boundary of the long-term ascending channel and has surpassed the 200-day moving average line. Several technical analysis indicators have formed signals for further upward movement. We do not exclude a bullish trend if COFFEE: D1 rises above its last maximum at 192. This level can be used as an entry point. The initial risk limit can be set below the Parabolic signal, the 200-day moving average line, the lower Bollinger Band line, and the two most recent lower fractals at 173.7. After opening a pending order, the stop loss can be adjusted along with the Bollinger Bands and Parabolic signals to the next fractal minimum. Thus, we are favorably adjusting the potential profit/loss ratio. The most cautious traders, after executing the trade, can switch to the four-hour chart and set a trailing stop loss in the direction of movement. If the price surpasses the stop level (173.7) without activating the order (192), it is recommended to remove the order as internal changes in the market have occurred, which were not taken into account.

商品 基本面分析 - 阿拉比卡咖啡

Latin America is expecting worsening weather conditions. Will the rise in COFFEE quotes continue?

The U.S. Climate Prediction Center has reported a warming of water in the Pacific Ocean, which could increase the likelihood of the formation of the natural phenomenon El Niño in the current year. Typically, El Niño causes drought in Brazil and rain in India, which can reduce global coffee production. Another positive factor for coffee quotes could be the announcement by the General Department of Vietnam Customs of a 2.2% y/y decrease in Vietnamese coffee exports from January to May, totaling 882 thousand metric tons. Additionally, the United States Department of Agriculture (USDA) forecasted a possible 20% y/y reduction in coffee production in Indonesia for the agricultural season 2023/2024, down to 8.4 million bags. The USDA had previously expected a 12% y/y increase in Arabica coffee production in Brazil in the current season, reaching 44.7 million bags. The forecast may be revised downwards in the event of the actual formation of El Niño. The Brazilian agency Conab has already slightly reduced its forecast for coffee harvest in Brazil for the current year in its May report compared to the January report. Regarding the current situation in the coffee futures market, it can be noted that the price of Robusta has reached a 28-year high, while the price of Arabica is still far from its local peak in February 2022.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.