- 分析

- 技术分析

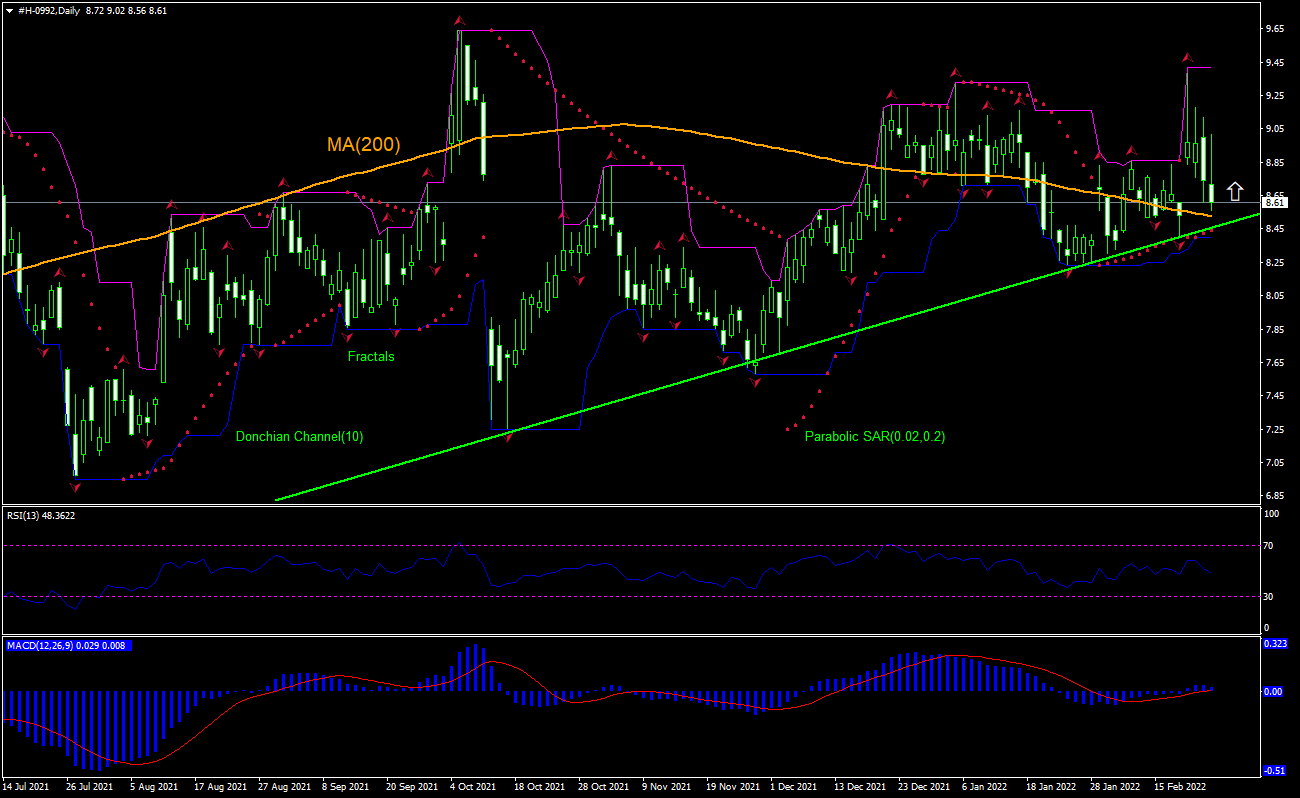

联想集团 技术分析 - 联想集团 交易: 2022-02-24

联想集团 技术分析总结

高于 9.42

Buy Stop

低于 8.4

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| Donchian Channel | 中和 |

| MA(200) | 买进 |

| Fractals | 中和 |

| Parabolic SAR | 买进 |

联想集团 图表分析

联想集团 技术分析

The technical analysis of the Lenovo stock price chart on daily timeframe shows #H-0992, Daily is testing the 200-day moving average MA(200) above the support line. We believe the bullish momentum will resume after the price breaches above the upper boundary of Donchian channel at 9.42. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower boundary of Donchian channel at 8.4. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (8.4) without reaching the order (9.42), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

股票 基本面分析 - 联想集团

Lenovo stock declined while the company reported better than expected results. Will the Lenovo stock price continue retreating?

Lenovo Group Limited develops, manufactures and markets commercial and consumer personal computers , as well as servers and workstations, data center solutions, and networking products. The company, which is based in Quarry Bay, Hong Kong, operates in China, the Asia Pacific, Europe, the Middle East, Africa, and the Americas. Its market capitalization is 102.8 billion HKD. The stock is trading at P/E ratio (Trailing Twelve Months) of 19.94 currently. Lenovo earned HKD 67.67 billion revenue (ttm) and Return on Equity (ttm) of 40.93% with Return on Assets (ttm) at 4.83%. Yesterday the company reported quarterly results. Third-quarter earnings jumped 62% over third quarter of 2020 to an all-time high of $640 million. Revenue for the quarter ended December 31 rose 17% over year to $20.1 billion, also a record and ahead of an average estimate of $18.4 billion from 10 analysts, according to Refinitiv data. Lenovo also said that it was on track to deliver its medium-term target of doubling its net income margin by the end of FY 2023/2024. High demand for more premium, portable and high-quality PCs due to growing popularity of hybrid work arrangements boosted demand for PCs, according to the world's biggest maker of personal computers. The company forecast the growing acceptance of hybrid work arrangement will drive PC demand even after the pandemic. Better than expected quarterly results are bullish for stock price. However, the stock closed 2.7% lower on Wednesday and is retreating currently.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.