- 分析

- 市场汇评

受风险偏好的影响,日元疲软 - 8.23

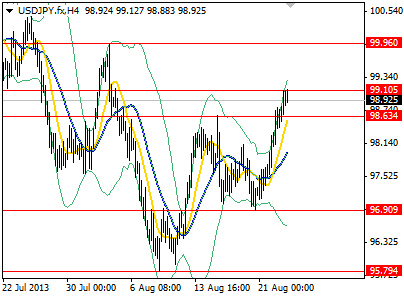

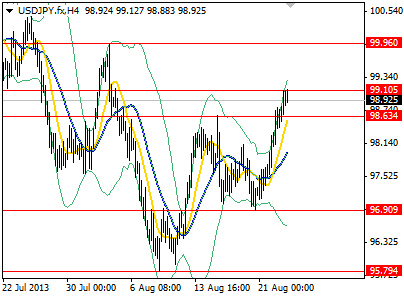

The Japanese Yen weakened further against its major counterparts as stronger PMI data from China, Europe and US suggested that expansion prevails in global economy lifting risk appetite, thus investors abandoned the safety of the Yen. Furthermore, US 10 year treasury yields rose to new high at 2.89% indicating that investors move their money out of bond markets to riskier assets as asset tapering expectation is growing among market participants. All that underpinned US equities last night followed by NIKKEI 225 that close higher by 2.21%, helping USDJPY to breach resistance at 98.63 yesterday and surging earlier today to 99.10.