- 分析

- 领涨/跌者

Top Gainers and Losers: Japanese Yen and Canadian Dollar

Top Gainers - global market

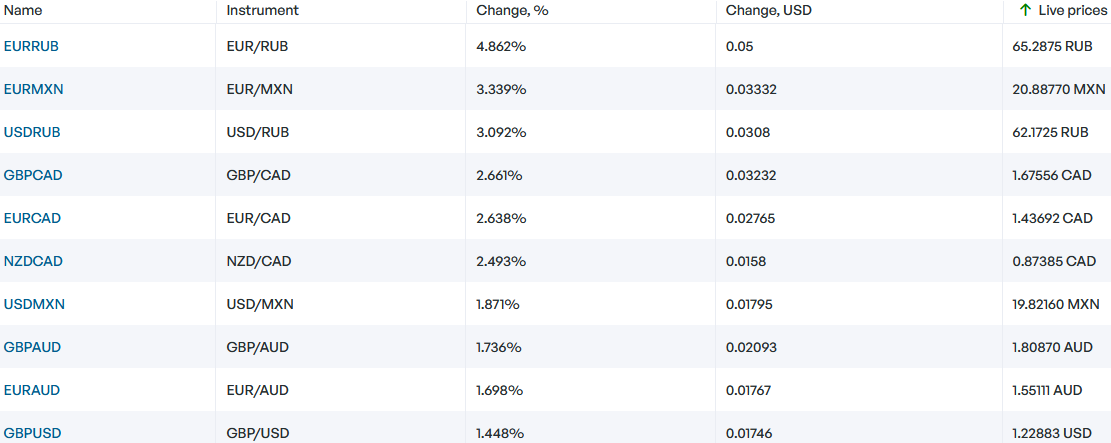

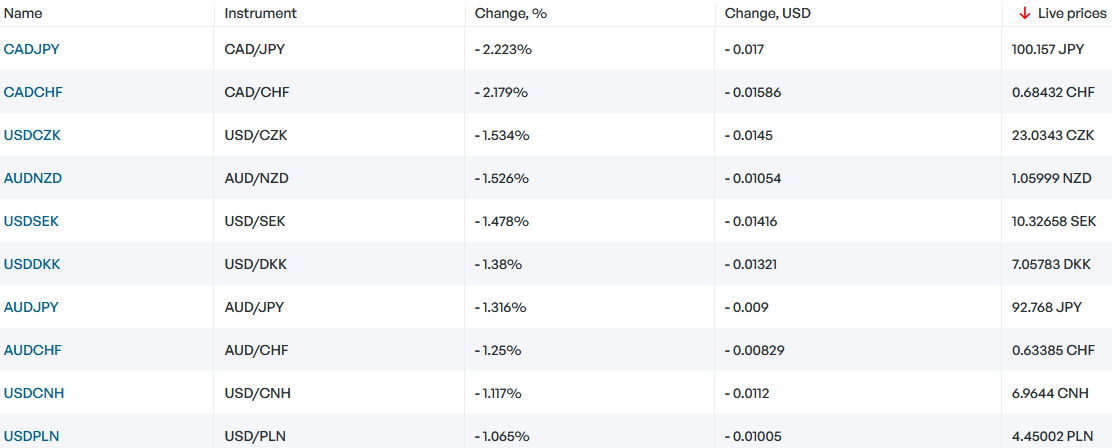

Over the past 7 days, the US dollar index remained almost unchanged. Investors are looking forward to the Fed meeting on December 14 and the rate hike to 4.5% from the current level of 4%. The euro showed strengthening ahead of the next meeting of the European Central Bank on December 15th. His rate (2%) can also be raised. An additional positive for the euro was the EU GDP growth of 2.3% y/y in the 3rd quarter. This is more than expected. The yen strengthened in anticipation of the tightening of the monetary policy of the Bank of Japan at its December 20 meeting. In addition, Japan Gross Domestic Product fell less than expected in the 3rd quarter (-0.8% y/y). The weakening of the Canadian dollar was facilitated by a relatively small increase in the Bank of Canada rate at a meeting on December 7 - to 4.25% from 3.75%. The Mexican peso weakened as inflation fell to 7.8% y/y in November. This may prompt an easing of the monetary policy of the Bank of Mexico at its December 15 meeting. His rate is now 10%.

1. Sands China Limited, +22.9% – casino and hotel management company in Macau

2. Wynn Macau, Limited, +61.9% – casino and hotel management company in Macau

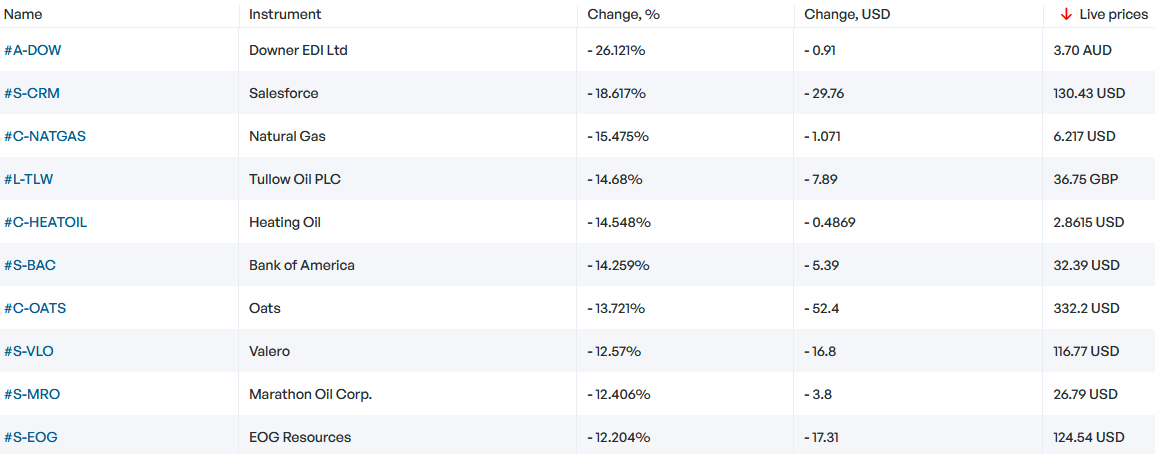

Top Losers - global market

1. Salesforce.com, inc. – American IT company, software developer

2. Downer EDI Limited – Australian multidisciplinary holding.

Top Gainers - foreign exchange market (Forex)

1. EURMXN, EURCAD - the growth of these charts means the strengthening of the euro against the Mexican peso and the Canadian dollar.

2. NZDCAD, GBPCAD - the growth of these graphs means the weakening of the Canadian dollar against the New Zealand dollar and the British pound.

Top Losers - foreign exchange market (Forex)

1. CADJPY, CADCHF - the fall of these charts means the weakening of the Canadian dollar against the Japanese yen and the Swiss franc.

2. USDCZK, AUDNZD - the fall of these charts means the strengthening of the Czech crown and the New Zealand dollar against the US and Australian dollars.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.

过往的赢家和输家

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...