- 分析

- 领涨/跌者

Top Gainers and Losers: US dollar and New Zealand dollar

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has continued to rise and has updated a new 2-year high. Investors expect the Fed to increase the Fed rate by another 0.5% at the meeting on May 4. Now the rate is 0.5% and looks very low against the background of powerful US inflation in March (+8.5% y/y). A similar situation is observed in Britain. High inflation (+7% y/y) in March could also strengthen expectations of a Bank of England (+0.75%) rate hike. The increase in the price of US natural gas was supported by good demand for liquefied natural gas (LNG) in the European Union after the imposition of sanctions on Russian pipeline gas supplies. The strengthening of the Russian ruble continued thanks to Russia's decision to sell natural gas and some other resources for rubles. The New Zealand dollar weakened despite the increase in the Reserve Bank of New Zealand to 1.5% from 1%. Investors fear high inflation in New Zealand according to data for the 1st quarter of this year. They will be published on April 20th. In the 4th quarter consumer prices increased by 5.9% y/y. The Australian dollar weakened despite good labor market data for March.

1.K&S AG, +17,6% – German manufacturer of potash fertilizers

2. Natural Gas, +16,2% – US Natural Gas CFDs (Henry Hub Natural Gas Futures)

Top Losers - global market

Top Losers - global market

1. AT&T Inc – American telecom company

2. Lenovo Group Limited – Chinese manufacturer of computer and electronic equipment.

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. GBPNZD, EURNZD - the growth of these charts means the strengthening of the British pound and the euro against the New Zealand dollar.

2. GBPJPY, GBPAUD - the growth of these charts means the weakening of the Japanese yen and the Australian dollar against the British pound.

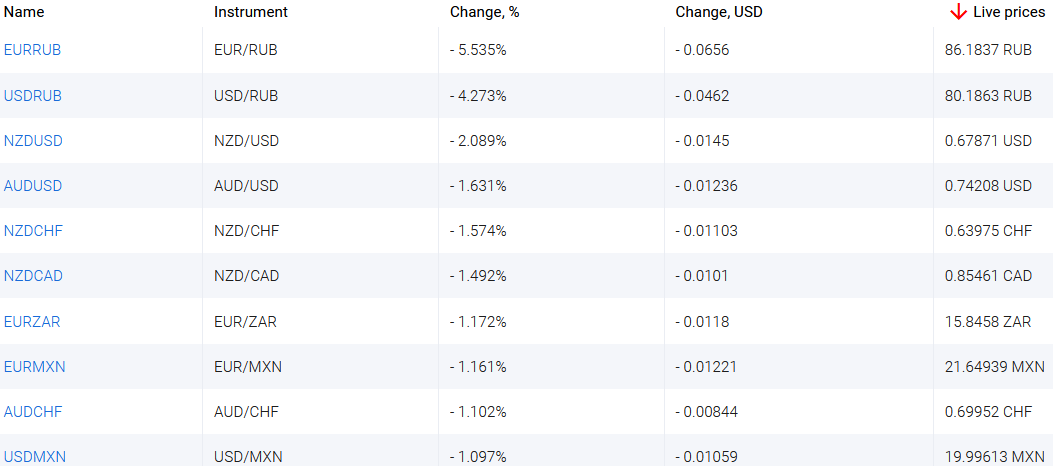

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. USDRUB, EURRUB - the decline of these charts means the weakening of the US dollar and the euro against the Russian ruble.

2. AUDUSD, NZDUSD - the decline of these charts means the strengthening of the US dollar against the Australian and New Zealand dollars.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.

过往的赢家和输家

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...