- 分析

- 技术分析

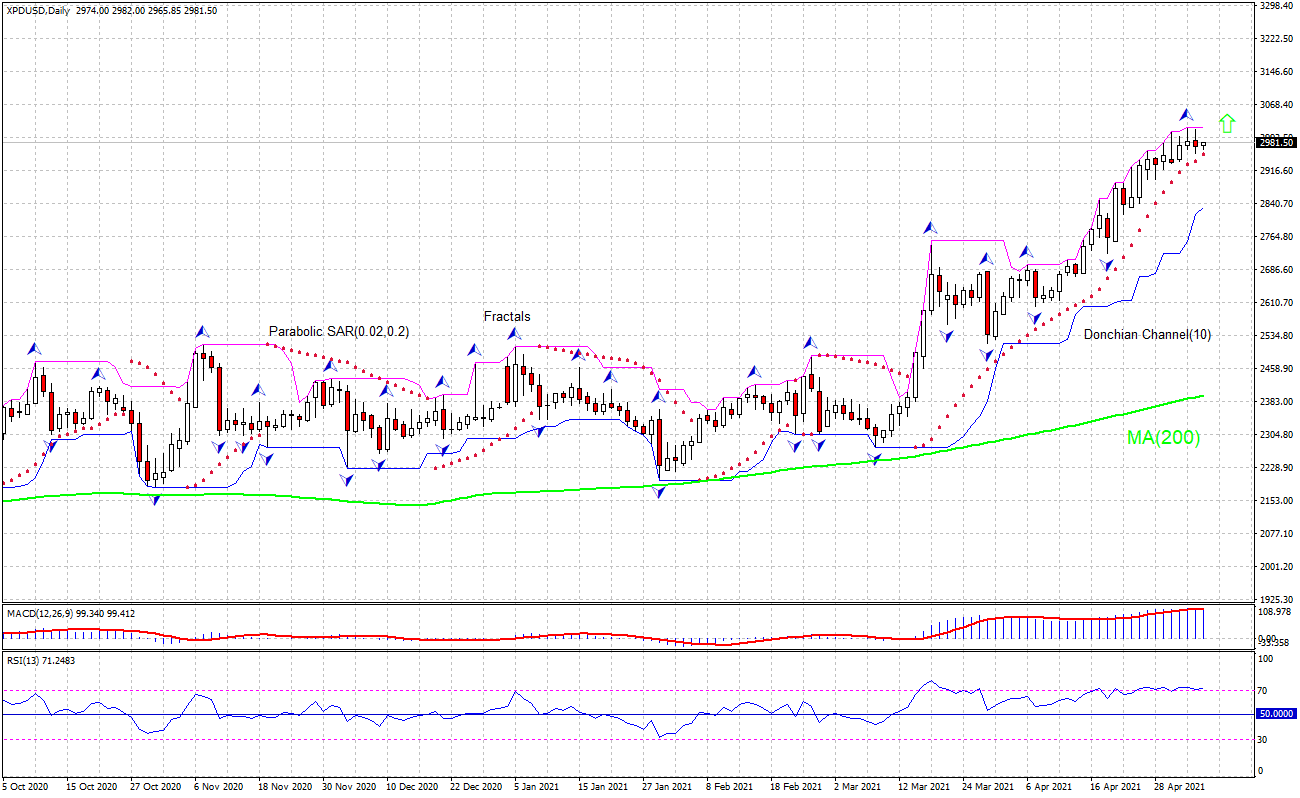

鈀 技术分析 - 鈀 交易: 2021-05-06

鈀 技术分析总结

高于 3017

Buy Stop

低于 2831

Stop Loss

| 指标 | 信号 |

| RSI | 卖出 |

| MACD | 买进 |

| Donchian Channel | 买进 |

| MA(200) | 买进 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

鈀 图表分析

鈀 技术分析

The XPDUSD technical analysis of the price chart on the daily timeframe shows XPDUSD,Daily has hit all-time high above the 200-day moving average MA(200), which is rising. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 3017. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower Donchian boundary at 2831. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (2831) without reaching the order (3017), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

贵金属 基本面分析 - 鈀

XPDUSD is rallying on recovery of global car sales while concerns over supply shortage of the metal persist. Will the XPDUSD continue rising?

Palladium is used in catalytic converters together with platinum and rhodium to reduce pollutant discharge of car exhausts. While demand from automakers gradually improves Palladium soared to a record high on Tuesday on worries over short supplies of the metal. Concerns about supply shortages were exacerbated after top producer Nornickel announced disruptions at two mines due to flooding. Expectations of rising car sales is bullish for XPDUSD.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.