- 分析

- 技术分析

黃金 技术分析 - 黃金 交易: 2020-06-24

黃金 技术分析总结

高于 1770

Buy Stop

低于 1670

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 买进 |

| MA(200) | 买进 |

| Fractals | 中和 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 中和 |

黃金 图表分析

黃金 技术分析

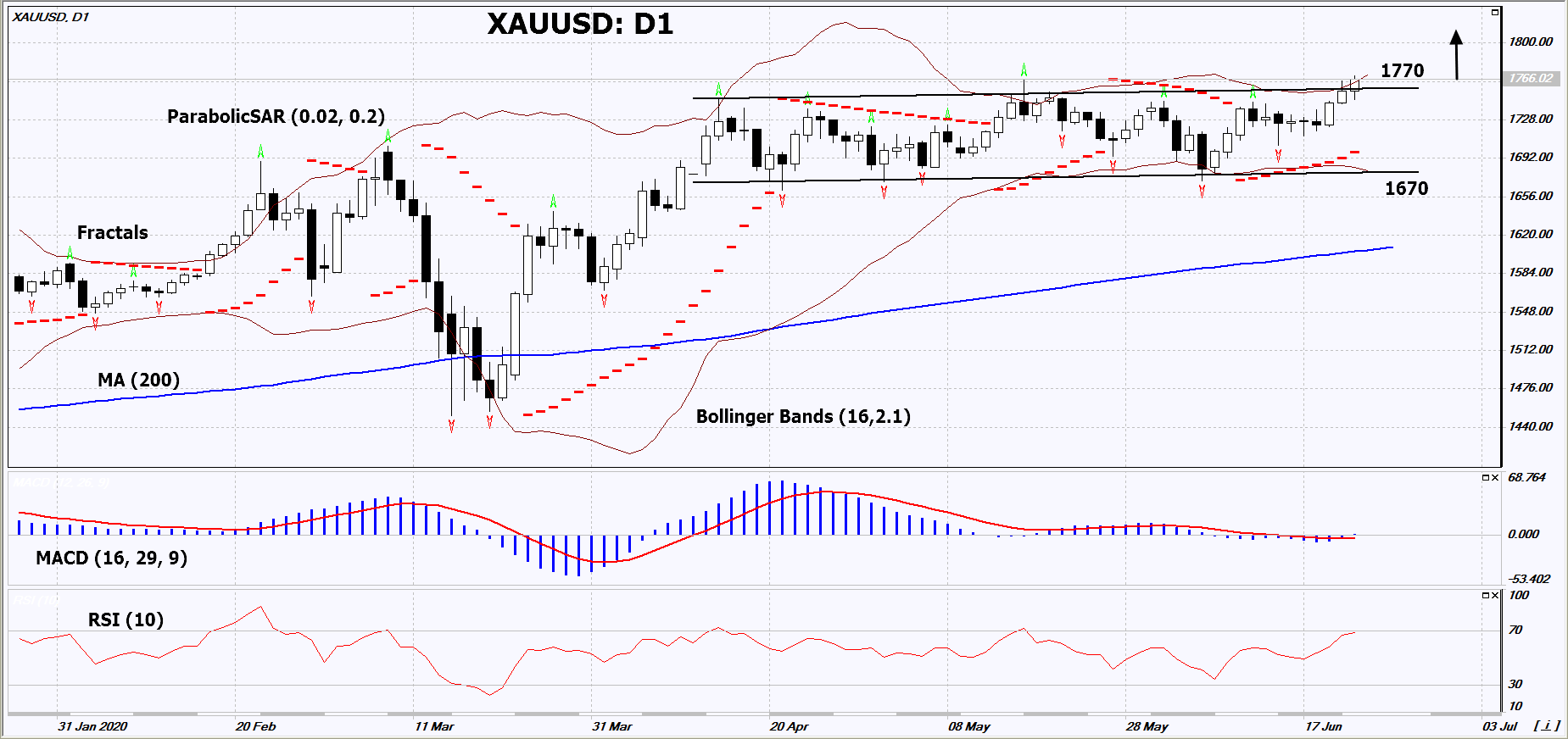

On the daily timeframe, XAUUSD: D1 went up from the medium-term neutral channel. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if XAUUSD rises above its last maximum and the upper Bollinger line: 1770. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the last 2 lower fractals and the lower Bollinger line: 1670. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop-loss, moving it in the direction of the trend. If the price meets the stop loss level (1670) without activating the order (1770), it is recommended to delete the order: the market sustained internal changes that have not been taken into account.

贵金属 基本面分析 - 黃金

The economic stimulus programs of the world’s central banks through monetary issuance are boosting demand for gold. Will the XAUUSD quotes continue to grow?

Virtually all Central Banks of developed countries are now issuing their currencies to support national economies affected by the coronavirus pandemic. New funds are used for concessional lending to businesses, the payment of benefits to the population and for the redemption of previously issued corporate debt securities. In April 2020, the US Federal Reserve announced a program of $ 2.3 trillion Aid to the American economy, known as Quantitative Easing (QE). The ECB has several times increased its Pandemic Emergency Purchase Program (PEPP). Now it is 1.35 trillion euros. Besides that, the ECB is now ready to offer additional soft loans to European banks in the amount of 1.31 trillion euros. Similar programs exist in Canada, Switzerland, Australia, Britain and other countries. For example, the Bank of Japan's assistance program for Japanese business is 110 trillion yen ($ 1.02 trillion). Theoretically, the global influx of liquidity can increase the demand for gold.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.