- 分析

- 技术分析

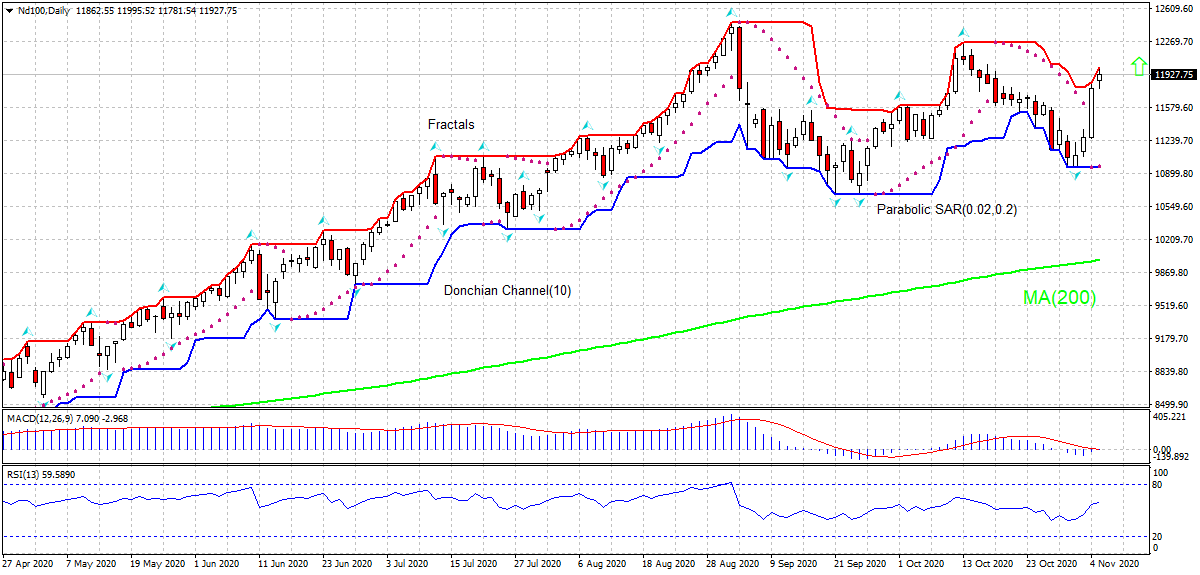

纳斯达克指数 - NDX100 技术分析 - 纳斯达克指数 - NDX100 交易: 2020-11-05

Nasdaq (100), 股票指数 技术分析总结

高于 11955.52

Buy Stop

低于 10955.12

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 买进 |

| Donchian Channel | 买进 |

| MA(200) | 买进 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

Nasdaq (100), 股票指数 图表分析

Nasdaq (100), 股票指数 技术分析

On the daily timeframe the Nd100: D1 is rebounding above the 200-day moving average MA(200) which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 11955.52. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 10955.12. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (10955.12) without reaching the order (11955.52), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

指数 基本面分析 - Nasdaq (100), 股票指数

US economic reports were mostly positive recently. Will the Nd100 rebound continue?

Recent US economic data were positive on balance. Manufacturing sector expansion accelerated in October. And while the expansion in services sector slowed it is still proceeding at a brisk pace. On the negative side private businesses slowed hiring in October. Thus, the Institute for Supply Management’s manufacturing activity index climbed to a 13-month high of 59.3 in October from 55.4 in September, and Markit’s final US manufacturing index ticked up to 53.4 in October versus an initial reading of 53.3. At the same time the ISM services PMI declined to 56.6 from 57.8 in September. Meanwhile Automatic Data Processing reported the US private sector hired 365 thousand new workers in October when a creation of 650 thousand new jobs was expected. And today the Federal Reserve will announce its decision concluding a two-day policy meeting. Investors are watching for US central bank plans to provide more monetary support for the US economy. Positive data are bullish for Nd100.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.