- 分析

- 技术分析

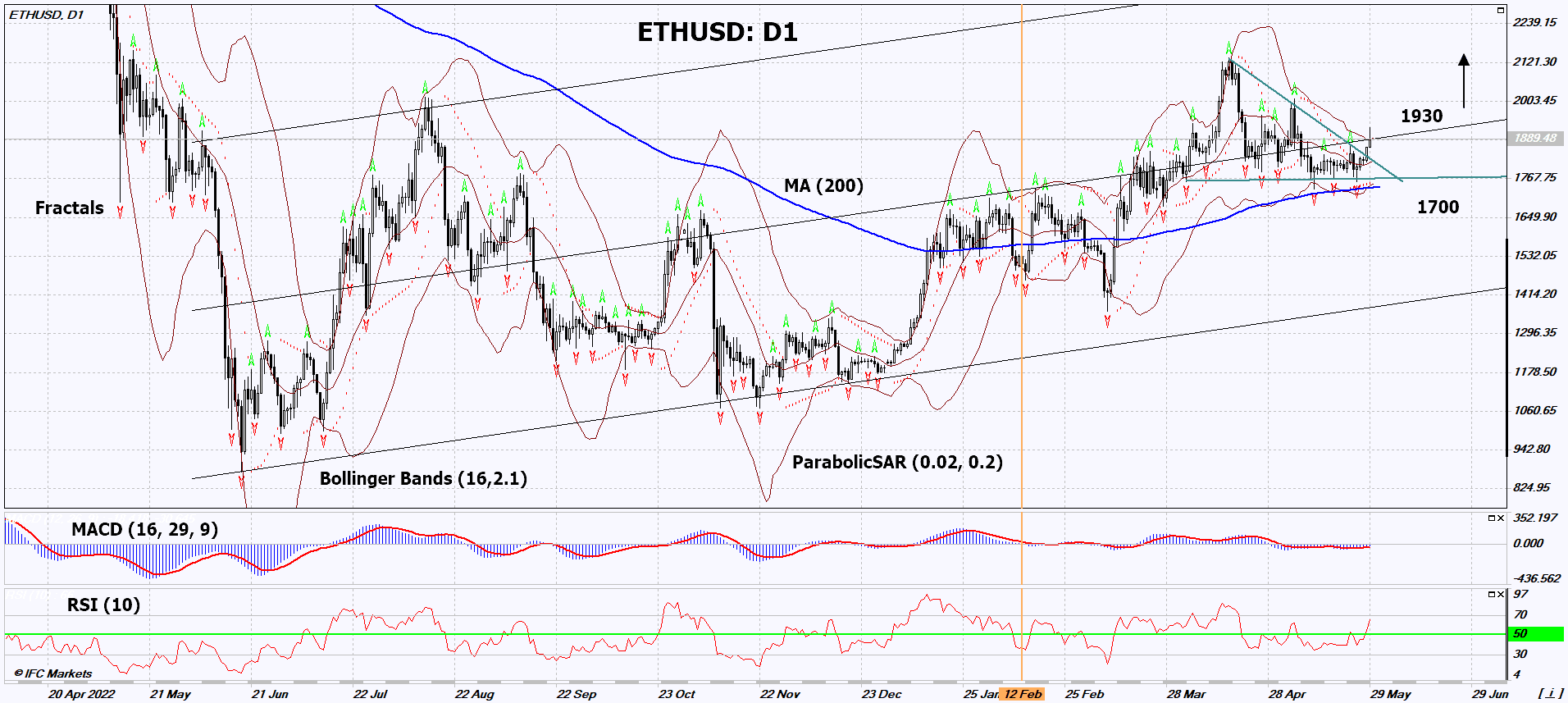

以太坊 / 美元 技术分析 - 以太坊 / 美元 交易: 2023-05-30

以太坊 / 美元 技术分析总结

高于 1930

Buy Stop

低于 1700

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 买进 |

| MA(200) | 中和 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

| Parabolic SAR | 中和 |

以太坊 / 美元 图表分析

以太坊 / 美元 技术分析

On the daily timeframe, ETHUSD: D1 is within a long-term ascending channel and has broken out of a triangle pattern. Several technical analysis indicators have generated signals for further upward movement. We do not exclude a bullish trend if ETHUSD: D1 rises above the last high at 1930. This level can be used as an entry point. The initial risk limit can be set below the Parabolic signal, the last three fractal lows, the lower Bollinger Band, and the 200-day moving average line, around 1700. After opening a pending order, we move the stop loss along with the Bollinger Bands and Parabolic signals to the next fractal low. This way, we improve the potential profit/loss ratio in our favor. More cautious traders, after entering the trade, can switch to the four-hour chart and adjust the stop loss in the direction of the movement. If the price surpasses the stop level (1700) without activating the order (1930), it is recommended to cancel the order: there are internal changes happening in the market that were not taken into account.

加密貨幣 基本面分析 - 以太坊 / 美元

Crypto market participants note the positive impact of the Shapella upgrade. Will ETHUSD quotes continue to rise?

The Shapella (Shanghai/Capella) Ethereum network upgrade took place on April 12, 2023. The majority of participants believe that it had a positive impact. Another factor contributing to the growth of Ethereum quotes could be the further reduction in the amount of Ethereum held in customer accounts on major cryptocurrency exchanges. This trend has been observed since September 2022 when reports of the bankruptcy of the FTX cryptocurrency exchange emerged. Additionally, there has been a simultaneous increase in the volume of Ethereum staking. Theoretically, this could indicate a decrease in the number of sellers of this cryptocurrency.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.