- 分析

- 技术分析

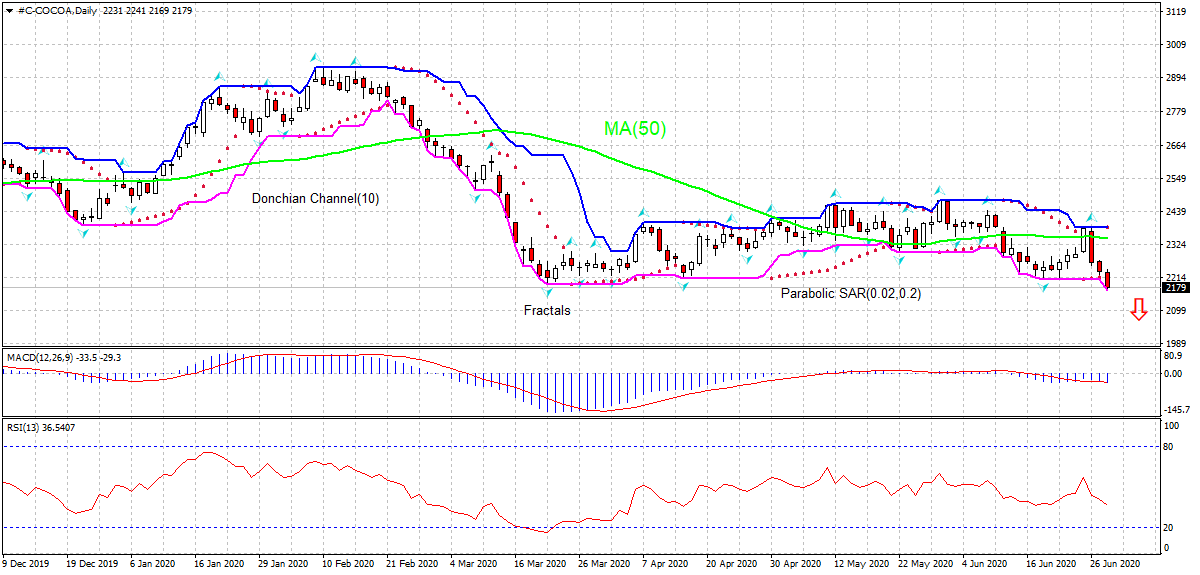

可可 技术分析 - 可可 交易: 2020-07-01

可可 技术分析总结

低于 2169

Sell Stop

高于 2385

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| Donchian Channel | 卖出 |

| MA(50) | 卖出 |

| Fractals | 卖出 |

| Parabolic SAR | 卖出 |

可可 图表分析

可可 技术分析

On the daily timeframe #C-COCOA: D1 has fallen below the 50-day moving average MA(50) which is declining. We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 2169. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 2385. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (2385) without reaching the order (2169) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

商品 基本面分析 - 可可

Coronavirus outbreak negatively impacts chocolate consumption. Will the cocoa price slide continue?

Chocolate global consumption has suffered from shutdowns since coronavirus outbreak. The International Monetary Fund lowered its outlook for the world economy couple of days ago. This is bad news for cocoa consumption, which is positively correlated with gross domestic product. In the year ended June 14, US sales of candy chocolate at traditional retail outlets fell 1.9% from a year earlier, according to IRI, a Chicago-based market researcher. Expectations of lower demand are bearish for cocoa.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.