- 分析

- 市场情绪

Weekly Top Gainers/Losers: Turkish Lira and Euro

Top Gainers – The World Market

Top Gainers – The World Market

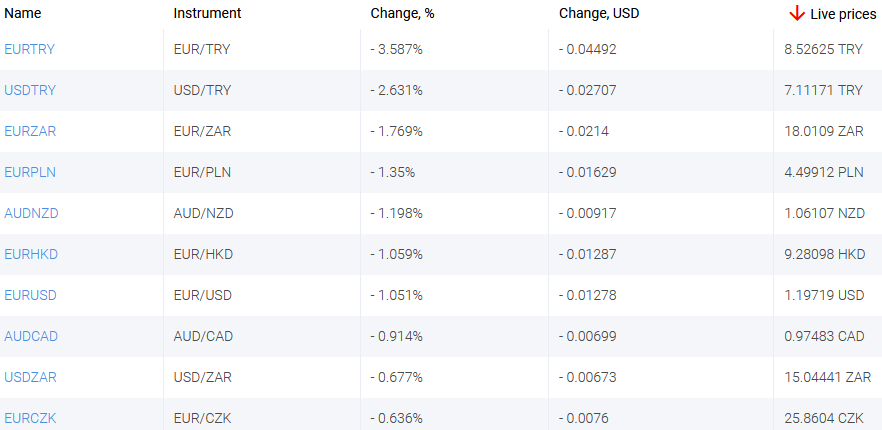

The US dollar has strengthened significantly over the past 7 days. Investors expect new US President Joe Biden's tax initiatives to cut government deficits. Euro fell in price amid weak EU macroeconomic data. Core Inflation Rate YoY in January rose to 1.4%. GDP Growth Rate YoY fell 5.1%. The Turkish lira strengthened due to the rise in the rate of the Central Bank of Turkey at the end of 2020 to 17%. At the same time, the Central Bank of Turkey intends to maintain high rates until 2023 and expects inflation to fall to 10% by the end of 2021.

1.Mitsubishi Motors Corporation, 17,1% – Japanese car company

2. Anglo-American PLC, 13,3% –British mining company

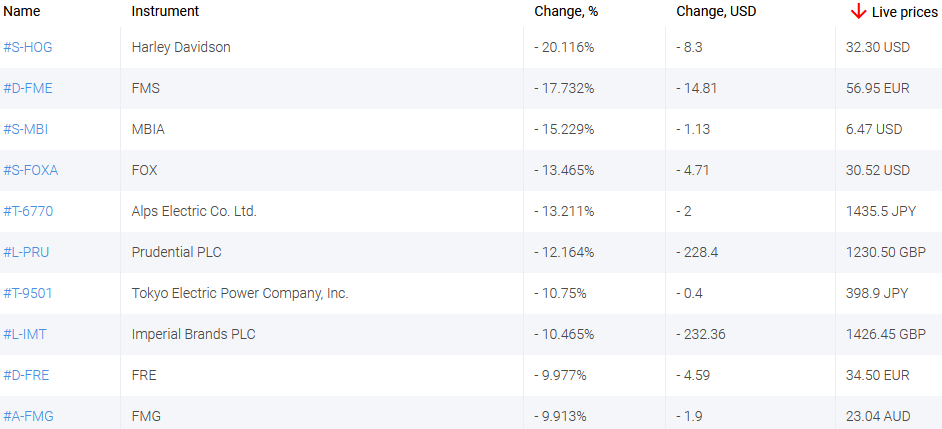

Top Losers – The World Market

Top Losers – The World Market

1. Harley-Davidson, Inc. – American motorcycle manufacturer

2. Fresenius Medical Care AG & Co KGaA – German medical equipment manufacturer

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDCHF, USDSEK - the growth of these charts means the weakening of the Swiss franc and the Swedish krona against the US dollar.

2. USDRUB, USDDKK - the growth of these charts means the strengthening of the US dollar against the Russian ruble and the Danish krone.

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. EURTRY, USDTRY - the drop of these charts means the weakening of the euro and the US dollar against the Turkish lira.

2. EURZAR, EURPLN - the drop of these charts means the weakening of the euro against the South African rand and the Polish zloty.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.

最新市场情绪

- 3月18领涨/跌者: 加元和日元

在过去的7天里,石油,有色金属和其他矿物原料的价格虽然有所下降,但仍保持在较高水平。因此,商品货币有所加强:加元,澳大利亚和新西兰元,墨西哥比索和南非兰特。在公布负面经济数据之后,日元走弱:贸易平衡,工业生产及该行业一系列商业活动数据。此外,日元受到日本银行行长黑田东彦讲话的负面影响,即日本的通货膨胀不太可能在2024年达到+...

- 3月10Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 3月4领涨/跌者: 美元和南非兰特

在过去的7天里,石油价格持续上涨。 包括黄金在内的贵金属价格下跌。 在这种背景下,石油公司的股票有所增加,俄罗斯卢布走强,澳大利亚和新西兰元以及南非兰特走软。 在美国政府债券收益率持续增长的推动下,美元走强。

...