- 分析

- 技术分析

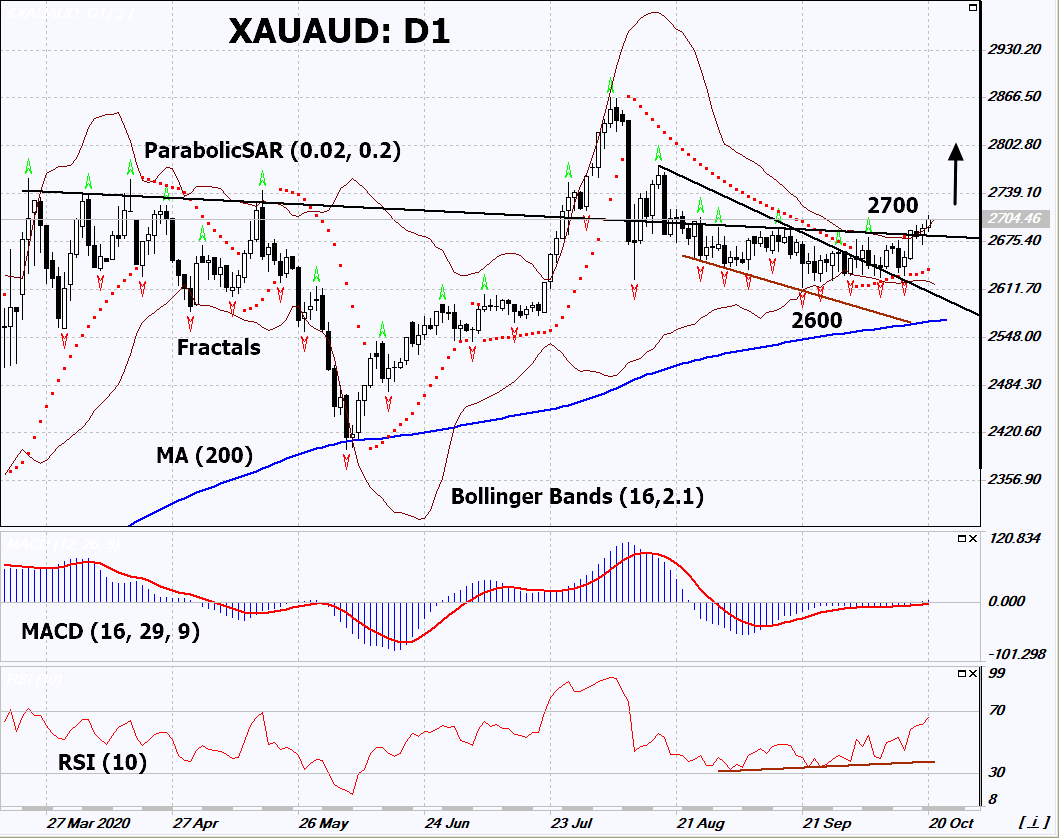

黄金对澳元 技术分析 - 黄金对澳元 交易: 2020-10-21

黄金对澳元 技术分析总结

高于 2700

Buy Stop

低于 2600

Stop Loss

| 指标 | 信号 |

| RSI | 买进 |

| MACD | 中和 |

| MA(200) | 中和 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 买进 |

黄金对澳元 图表分析

黄金对澳元 技术分析

On the daily timeframe, XAUAUD: D1 exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if XAUAUD rises above its last maximum: 2700-2710. This level can be used as an entry point. We can place a stop loss below the Parabolic signal and the lower Bollinger line: 2600. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch the 4-hour chart and place a stop loss, moving it in the direction of the bias. If the price meets the stop loss (2600) without activating the order (2700), it is recommended to delete the order: some internal changes in the market have were not been taken into account.

PCI 基本面分析 - 黄金对澳元

In this review, we propose to consider the XAUAUD Personal Composite Instrument (PCI). It reflects the price action of Gold vs the Australian dollar. Is the growth of XAUAUD quotes possible?

XAUAUD moves up with the weakening of the Australian dollar and the rise in gold prices. The main negative factor for the Australian currency is the plans of the RBA to ease its monetary policy and, in particular, to cut the rate to 0.1% from the current 0.25%. This was noted in the RBA Meeting minutes. In theory, the rate could be lowered at the next meeting on November 3. On Tuesday, Assistant Governor RBA Chris Kent said that his department didn't not rule out negative rates, as well as a significant currency issue aimed at bonds buybacks (following the example of the US Federal Reserve's QE program). In turn, gold may rise in price amid growing global risks due to the 2nd wave of coronavirus, uncertainty around the US presidential election, as well as US-China foreign trade disputes. In addition, demand for precious metals may increase if inflation rises and rates remain low in the most developed countries.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.