- 分析

- 技术分析

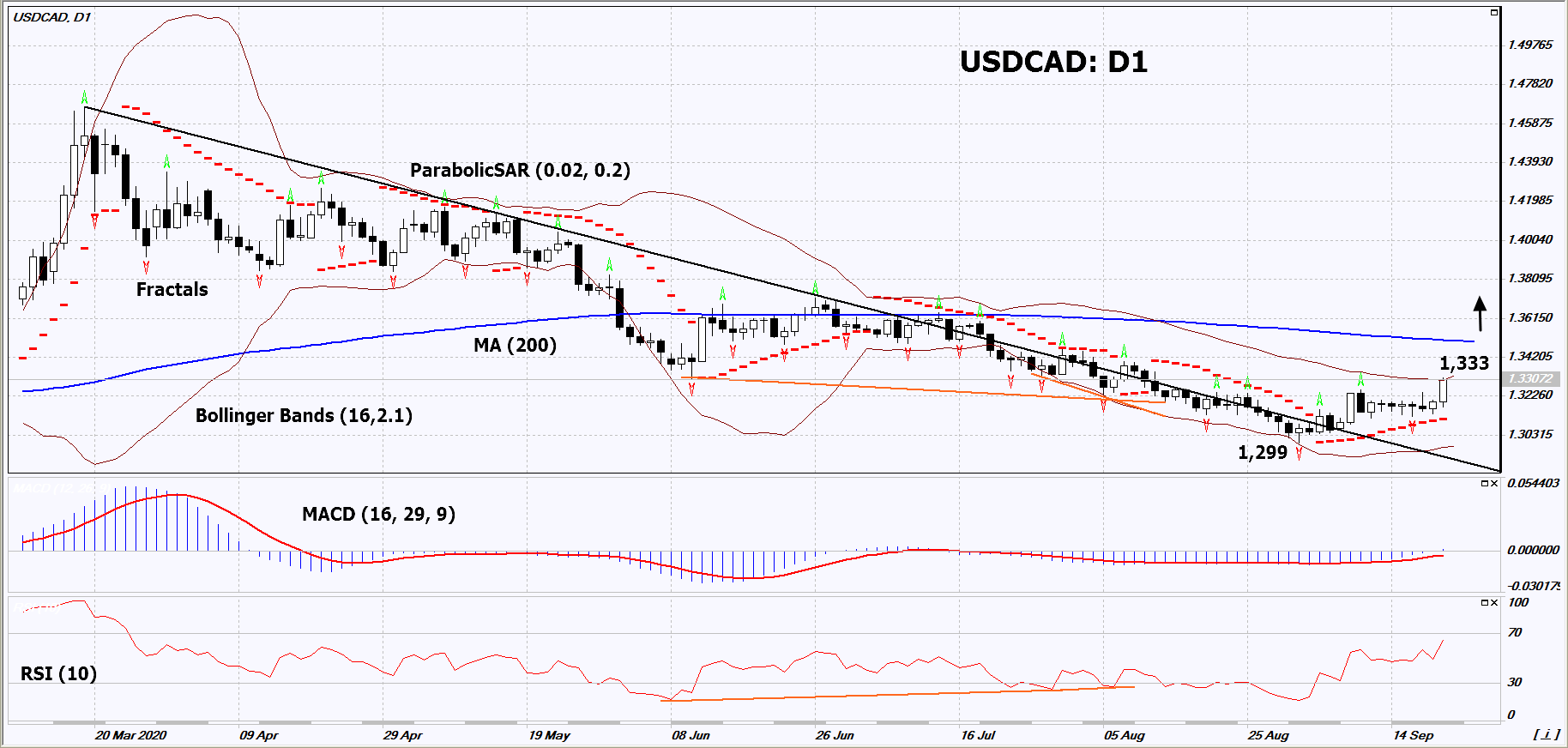

USD/CAD 技术分析 - USD/CAD 交易: 2020-09-22

USD/CAD 技术分析总结

高于 1,333

Buy Stop

低于 1,299

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 买进 |

| MA(200) | 中和 |

| Fractals | 买进 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 买进 |

USD/CAD 图表分析

USD/CAD 技术分析

On the daily timeframe, USDCAD: D1 exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish movement if USDCAD rises above the upper Bollinger band: 1.333. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger band and the last two lower fractals: 1.299. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.299) without activating the order (1.333), it is recommended to delete the order: some internal changes in the market have not been taken into account.

外汇交易 基本面分析 - USD/CAD

The Canadian economy is showing signs of slowing recovery from the coronavirus pandemic. Will the USDCAD quotes rise?

The upward movement means the weakening of the Canadian dollar. At the end of last week data on retail sales and ADP's negative data on the labor market were released in Canada. The number of jobs in August fell for the 6th month in a row (-205.4 thousand). Retail sales in Canada increased by 0.6% in July. This is much less than the 22.7% growth in June. No significant Canadian macroeconomic data is expected this week. However, the emerging correction in world oil prices may support the sliding of the Canadian dollar. Oil is getting cheaper in anticipation of increased production in Libya, as well as amid the increase in the number of new coronavirus cases worldwide. This may strengthen quarantine measures in some countries and weaken global demand. The U.S. Energy Information Administration notes a 13% decline in current US oil demand compared to 2019, and a 20% decrease in motor fuel demand. The International Energy Agency (IEA) projects a drop in the total global oil consumption in 2020 to 91.7 million barrels per day from 100.1 million in 2019. At the same time, according to the IEA, the recovery of global demand to last year's level may occur no earlier than 2023.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.