- 分析

- 技术分析

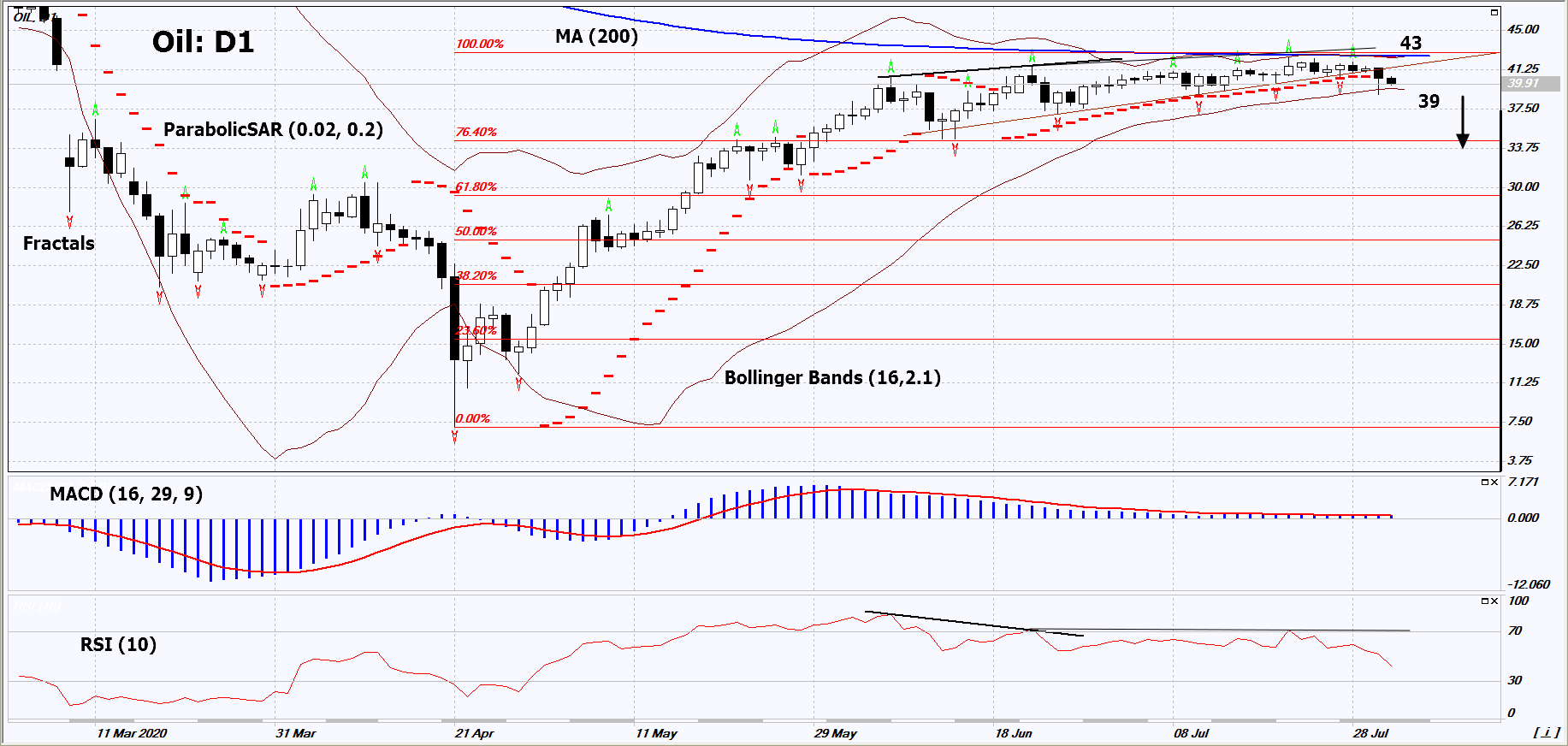

原油 WTI 技术分析 - 原油 WTI 交易: 2020-08-03

WTI原油 技术分析总结

低于 39

Sell Stop

高于 43

Stop Loss

| 指标 | 信号 |

| RSI | 卖出 |

| MACD | 中和 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 卖出 |

| Bollinger Bands | 中和 |

WTI原油 图表分析

WTI原油 技术分析

On the daily timeframe, Oil: D1 is being traded in a narrow neutral range for almost 2 months. A number of technical analysis indicators formed signals for a decline. We do not rule out a bearish movement if Oil falls below the lower Bollinger band: 39. This level can be used as an entry point. We can set a stop loss above the last two upper fractals, the upper Bollinger line, the 200-day moving average line and the Parabolic signal: 43. After opening a pending order, we should move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most risk-averse traders, after the transaction, can switch to a four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (43) without activating the order (39), it is recommended to delete the order: some internal changes in the market have not been taken into account.

商品 基本面分析 - WTI原油

Since August 1, 2020, OPEC + countries will increase oil production by 1.5 million barrels per day (bpd). Will oil quotes go down ?

On July 15, 2020, the OPEC + countries agreed to reduce the oil production limit from 9.7 million bpd to 7.7 million bpd from August 1. This means that the difference (or 2 million bpd) will additionally enter the world market. The real increase will be less, and will amount to 1.5 million bpd, as a number of countries such as Iraq and Nigeria have exceeded their oil production quotas in the past. In May, the overall OPEC + reduction quota was met by only 87%, bringing additional 1.26 million barrels per day to the world market. This did not prevent the growth in oil quotes. In June, the quota was met by 107%. The next increase in production, by another 2 million bpd, is expected only in early 2021, when the OPEC + production limit will be reduced to 5.7 million bpd. The continuation of the coronavirus pandemic may be another negative factor for oil prices. A number of countries are inclined to reintroduce quarantine, which will lead to lower demand.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.