- 分析

- 技术分析

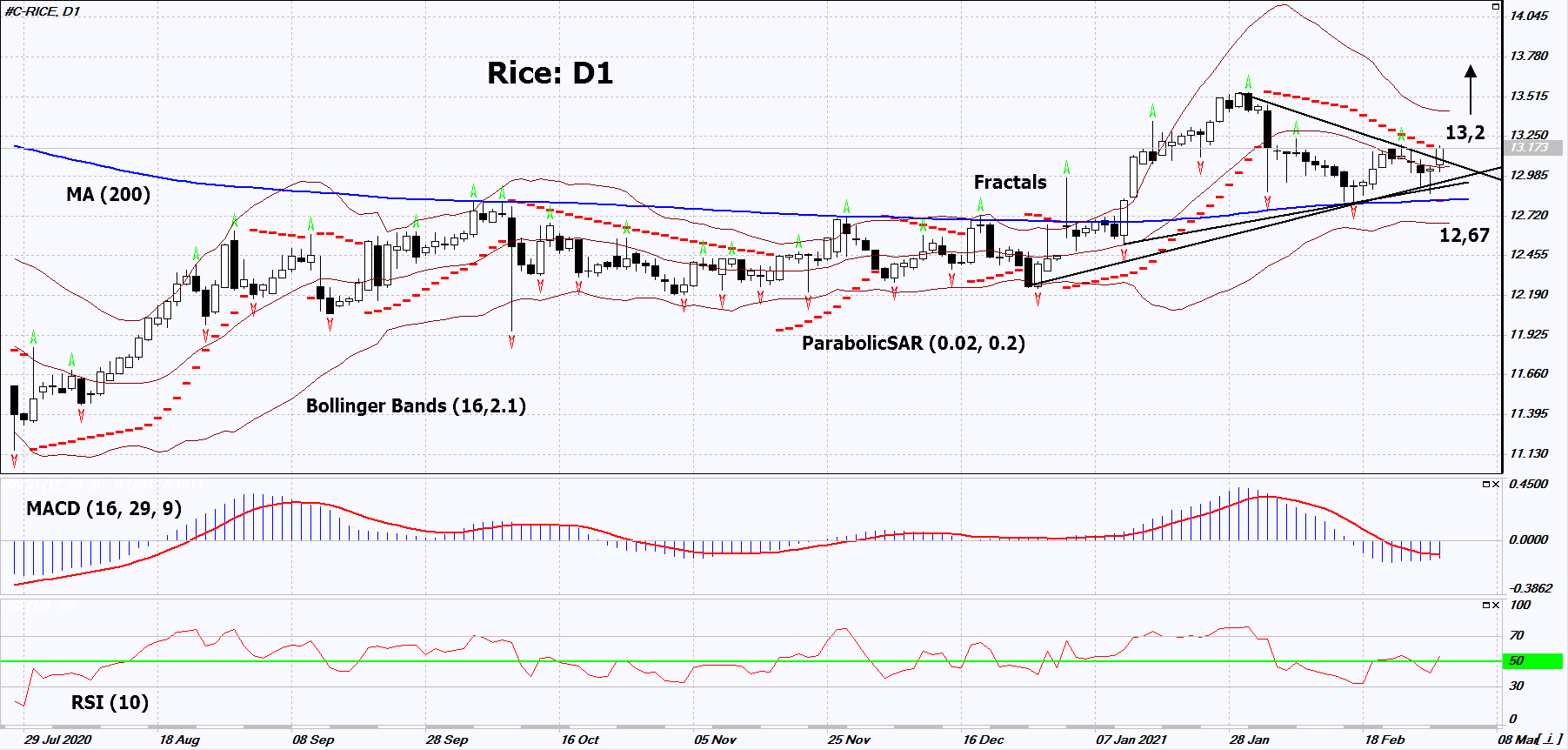

稻谷 (Rough Rice) 技术分析 - 稻谷 (Rough Rice) 交易: 2021-03-03

稻谷 技术分析总结

高于 13.2

Buy Stop

低于 12.67

Stop Loss

| 指标 | 信号 |

| RSI | 中和 |

| MACD | 卖出 |

| MA(200) | 买进 |

| Fractals | 中和 |

| Parabolic SAR | 买进 |

| Bollinger Bands | 中和 |

稻谷 图表分析

稻谷 技术分析

On the daily timeframe, Rice: D1 broke up the resistance line of the short-term triangle. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish movement if Rice: D1 rises above its last upper fractal: 13.2. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger band, the last lower fractal and the 200-day moving average line: 12.67. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and place a stop loss, moving it in the direction of the bias. If the price meets the stop loss (12.67) without activating the order (13.2), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

商品 基本面分析 - 稻谷

The USDA stated that global rice production declined in the 2019/2020 season. Will the Rice quotes rise?

According to the USDA, global rice production contracted by 1 million tons in 2019/2020 compared to 2018/2019, amounting to 496.3 million tons. At the same time, world consumption increased by 10.3 million tons, making up 495 million tons. Global rice consumption will increase to 500.4 million tons in the 2020/2021 season, according to USDA forecasts. It must be offset by an increased global harvest. Rice quotes are highly influenced by weather conditions.

附注:

本文针对宣传和教育, 是免费读物. 文中所包含的信息来自于公共渠道. 不保障信息的完整性和准确性. 部分文章不会更新. 所有的信息, 包括观点, 指数, 图表等等仅用于介绍, 不能用于财务意见和建议. 所有的文字以及图表不能作为交易的建议. IFC Markets及员工在任何情况下不会对读者在阅读文章中或之后采取的行为负责.